North America’s automotive parts suppliers are entering a long period of upheaval, marked by formidable challenges and risks with no easy answers. To prosper they must manage with poise and precision the transition away from their decades-long allegiance to the parts, processes, and partners of the internal combustion engine (ICE) market and align their capabilities with the new demands of electric vehicle (EV) production.

That will be easier said than done, of course. As the shift to EV production intensifies towards the remainder of the decade, there will be a profound impact on the demand for automotive components compared to traditional ICE vehicles. Many light-vehicle components (such as batteries and electric motors) will see strong growth. New processes will be required, and more exotic alloys will pose machining and tooling challenges. And yet, the ICE market and the parts, processes and partnerships that go with it, won’t disappear overnight. Nor will the ICE market’s profitability. Remaining relevant during this intermediate “twin-path” stage the automotive industry must get through is the tall task at hand and supplier survival is at stake.

“The wholesale transformation toward an electric mobility future means suppliers should not only think about what they produce but also how they produce it,” advise Jason Coffman, Raj Iyer, and Ryan Robinson of Deloitte Consulting in the recently published 2023 Deloitte Automotive Supplier Study. They add that suppliers should be thinking about which customer relationships they need to double down on and which new relationships they will need to forge.

“The transition to electric vehicles is beginning to apply enormous pressure on the competitive landscape where not every vehicle manufacturer is guaranteed to survive (at least in its current form). This risk applies to both established incumbents and emerging disrupters, requiring suppliers to make careful choices regarding the customer relationships they want to focus on,” warn Coffman, Iyer, and Robinson.

They also point to significant risks, and opportunities, on the supplier side. Many automotive suppliers have already invested in e-mobility divisions, but they may have been overly exposed to the financial pressures that plagued the automotive sector during the pandemic. That could create opportunities for larger integrators to bolster their market standing through acquisition.

“There may be a number of undervalued players that would be attractive targets for either strategic or financial buyers looking to take advantage of current conditions. Indeed, the potential for more M&A activity on the horizon in the supply sector is growing rapidly,” they write.

Selecting the strategies to get automotive suppliers through this stage without becoming sitting ducks for acquisition (or to be in the financial shape to do the acquiring) starts with understanding the scope of the market changes to come and the impact on the parts produced.

It’s time to take seriously the speed with which the move towards electrification is taking shape. The number of electric cars produced globally is forecasted to grow at a compounded annual growth rate of 33% to 125 million by 2030, according to the International Energy Agency, a global organization providing data and analysis of the transition to cleaner energy.

Looking specifically at the North American market, despite lower overall vehicle sales in 2022, demand for EVs increased significantly in the United States. Total US light vehicle sales fell 8% (to 13.9 million units) in 2022 — the lowest level in more than a decade. Yet US EV sales jumped approximately 65%, representing 5.8% of new cars sold in 2022 (versus 3.1% in 2021). The upward trajectory in US EV sales is expected to continue, reaching sales of 21% or 3.4 million light vehicles by 2030. On this side of the border, a record 86,032 electric vehicles were registered in Canada in 2021, making up 5.3% of total vehicle registrations for that year, according to Statistics Canada, and EV sales will continue to grow over the next decade, driven by government mandate. EV sales in 2022 grew by 35% compared to the previous year’s already impressive numbers and Ottawa recently released final regulations to ensure that all new passenger cars sold in Canada by 2035 are zero-emission vehicles. Ramping up to that, one-fifth of all passenger cars, SUVs and trucks sold in Canada by 2026 must be electric and the federal mandate rises to 60% of all sales by 2030.

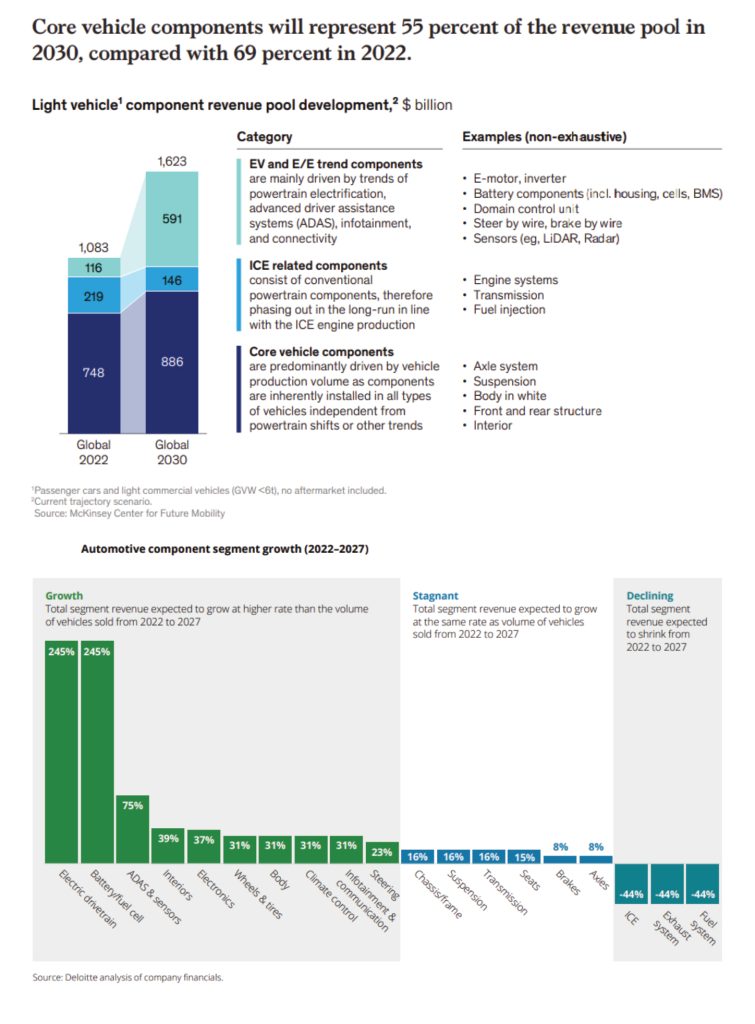

In its report Work the core: How auto suppliers can get fit for the EV transition McKinsey & Company provide estimates for how the global vehicle component market will transform from 2022 to 2030. Of concern to suppliers currently focused solely on ICE related components (engine systems, transmissions, and fuel injection systems) is that the value of this market segment is expected to decrease significantly from the $219 billion reported in 2022 to an estimated $146 billion by 2030. Conversely, the value of EV components and advanced electronics components, such as powertrains, advanced driver assistance systems and infotainment electronics are forecasted to account for 36% of the market by 2030 compared with 11% in 2022, growing from $116 billion in revenues to $591 billion.

Yet, here is where things get complicated, requiring automotive suppliers to smartly strategize how they will navigate the transition. Even as electrification rolls out, the majority of parts will remain the same as they were in vehicles powered by ICE.

Core vehicle components, including the axle system, suspension, body in white, and front and rear structure, will remain a key part of the equation. McKinsey & Company estimates these will represent 55% of total market revenues by 2030, compared to 69% at present, and will generate revenues of $886 billion, compared to $748 billion

in 2022.

“We don’t really do much under the hood products that might go away. A door panel is a door panel. A fascia is a fascia,” is the pragmatic approach taken by Ed Ergun, director of corporate sales for Sybridge Technologies, a custom manufacturing solutions provider with facilities in Windsor and around the world. “If anything, the OEMs took a certain number of models and they expanded that to more models, therefore more material is required overall. Less volume, so Tier 1s are going to feel pain because the volumes are going to be lower but for us if you’re going to run 50,000 pieces you’re going to need a mold. There are several EV models and new players out there and as long as people can afford them, I don’t think the transition touches us at all,” Ergun says.

ICE cars and trucks sold into the North American market by the end of this decade will likely remain in operation till the 2040s. They will need parts for maintenance and repair during their operating life, retaining the viability of a market for suppliers servicing such needs.

“As the transition to EVs plays out, the task for supply-side decision makers will be to retain a firm grip on the most promising aspects of the business. In most cases, this could mean staying focused on core vehicle components while aligning with the latest trends and closely monitoring opportunities associated with the EV rollout,” the McKinsey & Company report states.

For suppliers opting for a strategy that calls for a quicker transition to servicing the EV market, there are distinct challenges with new materials and processes to overcome.

Gigacasting, a process that allows vehicle manufacturers to cast large vehicle parts in a single piece rather than stamping or casting dozens of separate parts and then welding, fastening or bonding them together, is changing how vehicles come together. Tesla pioneered gigacasting for EVs in 2020, utilizing two giant gigastings for the front and rear underbody in their Model Y car. The two castings replaced 171, eliminated 1,600 welds, and removed 300 robots from the assembly line. Since then traditional OEMs such as General Motors, Toyota, Hyundai, Volvo, and Mercedes-Benz are either using the process or plan to. S&P Global Mobility has forecasted that up to 20% of traditional body-in-white stampings by 2030 may go the gigacasting route. The gigacasting trend is expected to lead to larger structural parts and that will impact equipment selection.

“With gigacasting we are seeing a lot of potential changes. It’s not happening on a super large scale yet, but we are seeing a move toward larger cast components being used for the structure of the vehicle. That I think will drive a lot of different machine platforms,” says Craig Voss, proposal engineer, with Makino. “Larger structural parts are going to require larger machines. Those machines are not going to necessarily require the large, heavy-duty spindle that was formerly associated with large equipment. What we will be looking at for the large structural parts is larger machines with a large work zone but a smaller, more agile spindle.”

The use of high-strength aluminum alloys in EV components is another challenge. High-strength aluminum alloys are known for their excellent strength-to-weight ratio, providing the required structural strength while being significantly lighter than traditional materials like steel. They’re crucial for EVs as reduced weight contributes to improved energy efficiency and extends driving range, a main current concern about EV performance. High-strength aluminum alloys, however, can be less formable and more challenging to machine compared to traditional materials. Manufacturers encounter difficulties in shaping complex components, and machining processes can be more demanding.

“In order for a die cast type material to be used in a structural application, it needs a little more ductility than we see in some of the typical aluminums. So they’re alloying different elements that allow for that ductility and what that’s leading to is different challenges in the machining. One of those is stringy chips. Typically, a die cast aluminum part would chip very easily with no issues but with the new alloys required there are more stringy chips coming off tools. Those pose all kinds of problems for the tooling, the machine, evacuation, and chip conveyors,” explains Voss.

But he believes Makino is ahead of the curve on that challenge. Its GI Breaker control function allows Makino machines to eliminate those strings and create the small chips that the chip conveyor will handle very well.

“In the past this was handled by peck drilling, which is very slow, inefficient, and hard on the machine. We’ve taken that to the next level. When you watch a GI Breaker cycle and a normal drilling cycle you really will see virtually no difference. It’s literally milliseconds difference in time but it eliminates these problems,” Voss says.

Supplier success in transitioning to EV part production may also drive equipment changes. As EVs reach full market capacity, part production volumes will rise. What was done to make 250,000 parts per year, however, may not necessarily be the right equipment strategy when contracted to make one million parts per year.

For example, Voss says many Makino customers use horizontal pallet changers to drive efficiency – while you’re loading a part you are still machining.

“The pallet changing machines have been great but the higher we go in volumes, you do have two pallets and two fixtures to put on that machine and there are some additional costs to consider. So when you start making up to a million parts and you are talking about 10 or 20 machines, all of a sudden that starts becoming maybe an expensive option that is difficult to justify,” Voss explains. “So what we see in high volume, low mix type production is potentially a move to single-pallet machines that are robot loaded.”

Another technology innovation that may grow with the maturing of the EV market is additive manufacturing. There are two areas where additive manufacturing could prove a game changer for the $1.5 trillion parts and accessories manufacturing sector. Additive manufacturing technology is capable of producing components with fewer design restrictions that often constrain more traditional processes. Additive technologies are also increasingly able to produce multimaterial printed parts with individual properties such as variable strength and electrical capability. In combination, this could pave the way for significant product innovation for the manufacturers willing to invest in additive manufacturing.

The other benefit of additive manufacturing is as a driver of automotive manufacturing supply chain transformation. By eliminating the need for new tooling and directly producing final parts, additive manufacturing cuts down on overall lead times. In addition, additive manufacturing does away with much of the scrap created by the traditional subtractive machining methods, driving down material usage.

With several competing technologies, constant technology evaluation during this intermediate stage as EV manufacturing matures will

be critical.

“Our job is to also look at what’s coming down the pipe. What’s going to be the next metamorphosis,” says Tim Galbraith, general manager, Cavalier Tool & Manufacturing. He acknowledges that his company will likely have to manufacture molds differently than in the past and adds that the evaluation will need to extend beyond technology.

“We have to be able to look to the future and decide what skill sets are going to be needed and get ready to bring them on as well,” he says.

In the end it boils down to walking the tightrope between maintaining profitability on current ICE contracts while investing in the technologies and people skills necessary to seize future opportunities presented by EV vehicles. It’s a risky undertaking for sure but as the authors of the McKinsey report warn, the biggest risk in a time of change is inertia. SMT